Create Better Financial Relationships

Through secure, auditable employee–customer conversations across your business

Enable trusted, compliant, real-time interactions across banking and insurance with Jodo for Financial Services & Insurance.

BANKING

One Framework for All Your Business Connections

Deliver convenient, fast, and compliant customer service using a single execution framework designed for regulated financial environments.

VideoKYC

Secure VideoKYC journeys deployable in days, integrated directly into onboarding workflows—reducing friction while maintaining compliance.

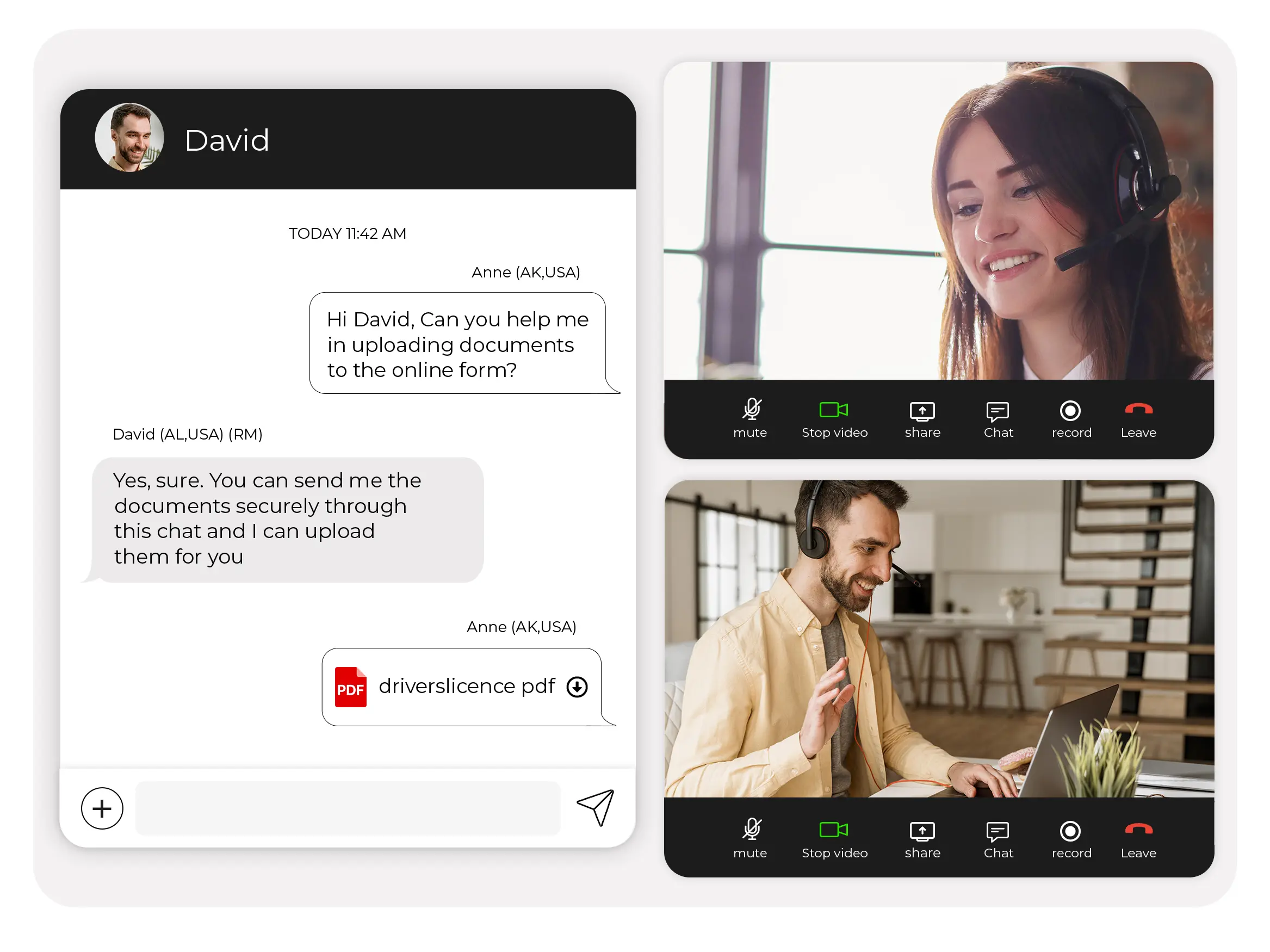

Complex Made Easy

Assist customers during onboarding with real-time screen and document sharing, improving completion rates and customer confidence.

Virtual Numbers

Enable secure, one-to-one connections between customers and relationship managers with role-based access and controlled identity masking.

Jodo Link

Use secure digital video calling to engage customers directly from links embedded in emails, documents, or web journeys—with full logging.

Secure Records & Auditability

Secure Records & Auditability

Risk Management

All interactions are recorded with consent, logged, searchable, and auditable—supporting regulatory reviews and internal controls.

Reduce Servicing Cost While Improving Compliance

Lower operational effort and rework through assisted digital journeys—without compromising governance or oversight.

INSURANCE

Productivity and Trust for the Business of Indemnity

Productivity and Trust for the Business of Indemnity

API's for Integration

Real-time access to policy, customer, and claims data through CRM and core system integrations.

FNOL & No-Wait Assessment

Enable First Notice of Loss (FNOL) and real-time assessment of damage, injuries, or property loss using secure video interactions.

Faster Claims Processing

Accelerate claims resolution through assisted, real-time workflows, reducing backlog and processing delays.

On-demand Video verification

Secure, remote customer verification with consent recording and audit trails, deployable without physical visits.

United teams

Route interactions across field force, partners, surveyors, branch offices, and back-office teams using intelligent routing rules.

Liability & Risk Management

Improve transparency and accountability with recorded interactions, controlled access, and traceable decision paths.

Features

Omni-Channel

On-demand video, voice, and chat from websites, emails, QR codes, and digital assets.

Quick adoption

Rapid enablement of WFO / WFH / Hybrid models, with integrations into CRMs and collaboration tools.

Accurate Context

Reliable capture of customer location, identity signals, and interaction context to support compliance and risk controls.

Channel Fusion

Seamless integration of digital and traditional communication channels within a single execution layer.

Better Engagement

Browser-based access enabling teams and customers to connect securely from anywhere.

Privacy Protection

Virtual numbers and identity controls protecting both customer and employee privacy.

Effective Handling

Easy digital & traditional communication channels integration.

API's

Easy team & Customer engagement through any channel from anywhere with browser based solutions.

Compliant

Global Compliance with OFCOM, APSEC, & TRAI

Business Scenarios

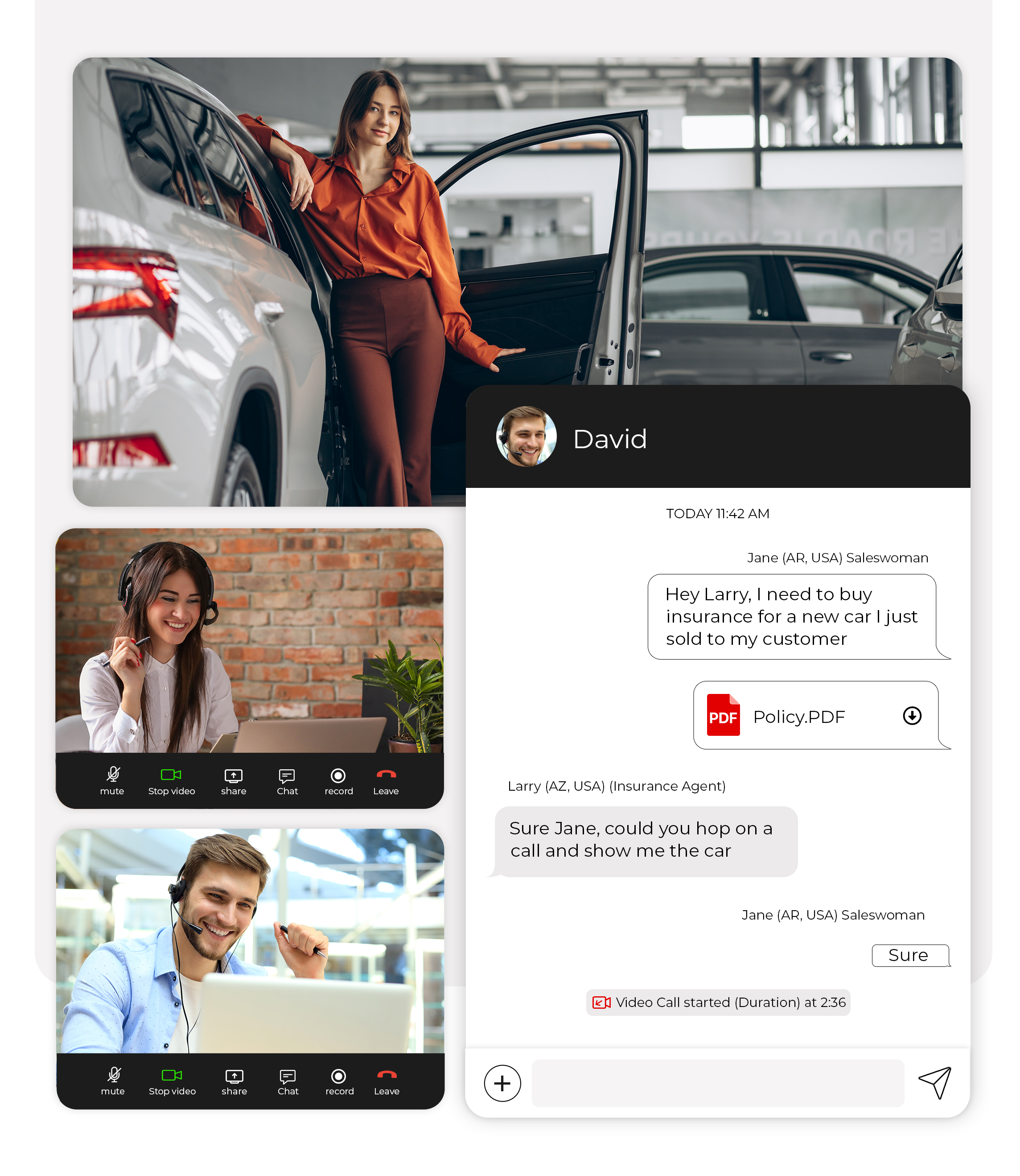

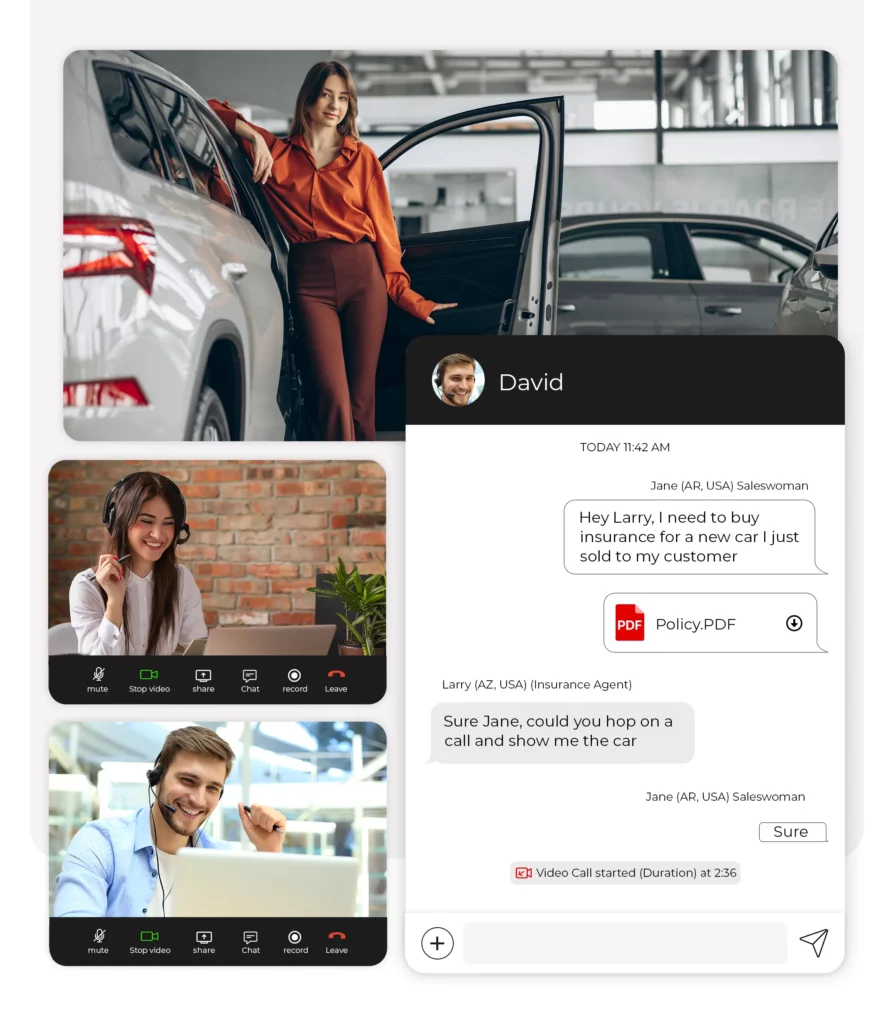

Assisted Sales & Servicing in Financial Products

Financial services face intense competition across products like credit cards, loans, insurance, and mortgages. Differentiation often comes down to timely engagement and follow-up.

A financial institution embedded Jodo into its sales workflows to enable real-time, assisted conversations during high-intent moments—improving conversion without increasing compliance risk.

Automation for Collection Management

To prevent policy lapses and improve renewal rates, an insurance provider automated pre-renewal reminders using Jodo integrated into its CRM.

Customers received timely voice and digital prompts, with escalation to human assistance when required—ensuring no lapses, no delays, and full auditability.

Claim's Management

An insurance company aimed to improve transparency and accuracy in claims assessment.

By enabling video-based damage assessment, customers, surveyors, and insurers collaborated in real time—ensuring fair evaluation, faster resolution, and complete interaction records.